Introducing 10K Advisors’ First Annual Salesforce Talent Ecosystem Report

The Salesforce talent ecosystem is one of the most vibrant and dynamic in the world. Not surprising considering it is built around one of the world’s most innovative companies, a rocket ship that’s not showing signs of slowing even as it’s achieving massive global scale.

Hundreds of thousands of businesses depend on Salesforce to run their marketing, sales, service and operations, and there are now more than 1,000 Salesforce consulting partners competing to help those customers be successful. Hundreds of third party software vendors are also betting their businesses on the Salesforce platform, and vying for the nearly 6 million installs generated via Salesforce’s AppExchange.

The opportunities are massive.

But if you’re one of those customers or partners, what are the challenges and opportunities when it comes to sourcing the talent you need to grow your business using Salesforce?

And what is it like to be one of the administrators, developers, architects, or consultants who are supporting these customers and vendors, or who are looking to form a career in the ecosystem?

We’ve begun investigating some of these questions in our first Salesforce Talent Ecosystem Report that was released today. This is the first in a series of reports that we will be releasing to help customers, partners, and Salesforce professionals navigate this rapidly evolving market.

Click here to download a free copy of 10K Advisors’ 2018 Salesforce Talent Ecosystem Report.

Why conduct this research?

10K Advisors has a pretty simple model. We connect Salesforce customers and partners to proven Salesforce talent, acting as a broker and advisor between the people who need Salesforce skills and the people who provide them. As part of our model we also give both groups the support they need to be successful and the freedom they need to excel at the work they love (learn more about how we do that here). In order to do this well, we have to keep a pulse on the data and trends that affect both our customers and our community of experts.

We also conducted this research for current and prospective Salesforce professionals, to help them identify potential career paths and navigate the opportunities and obstacles they may face.

This research is for our current and prospective customers — the heads of sales, service, marketing or IT who are searching for the skills and support they need to make sure their Salesforce investments ultimately pay off.

Finally, it is for all those investors and partners who are entrenched in the Salesforce ecosystem, who want to know what is happening and how things are trending.

What did our research show?

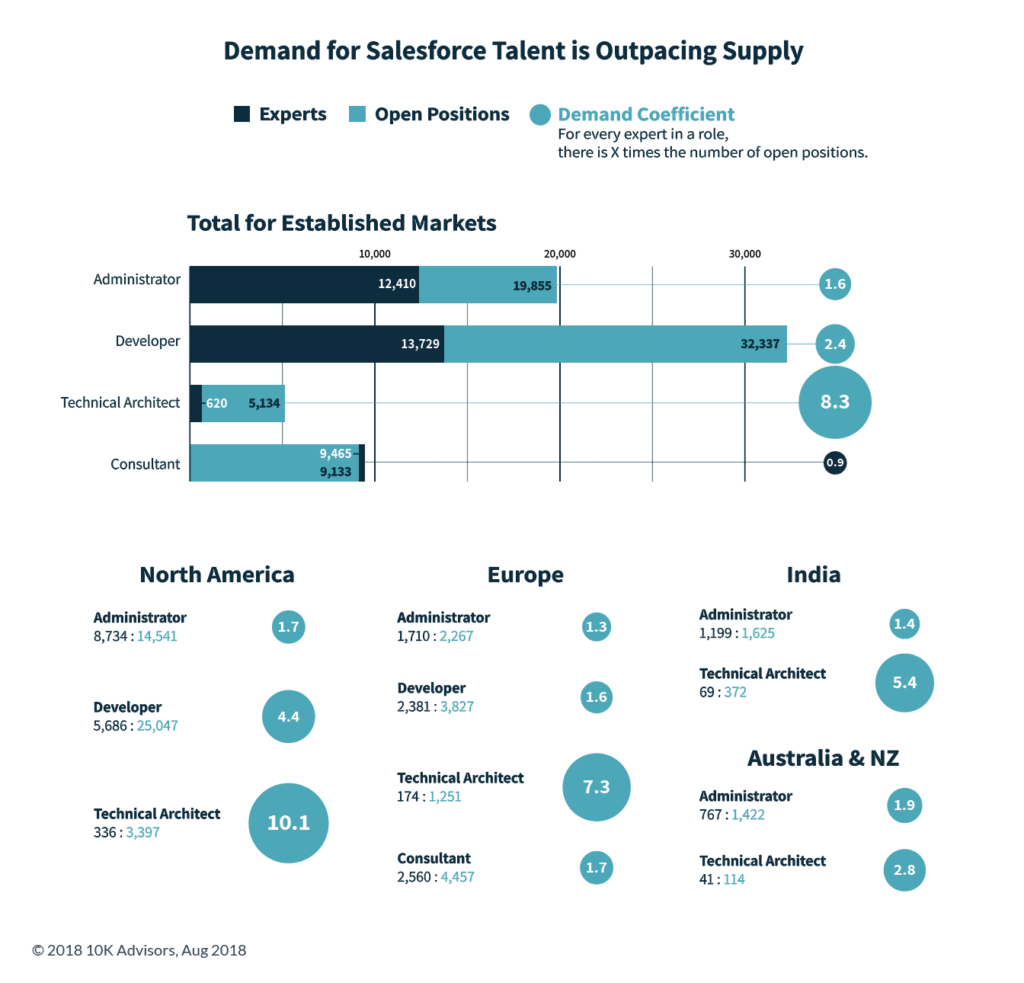

Some of the research findings served to confirm what we already knew, but there were some surprises as well. We knew that Salesforce skills were in high demand. Customers and partners are finding it difficult to find and keep the talent they need. What surprised us though was just how in demand certain roles were within the ecosystem.

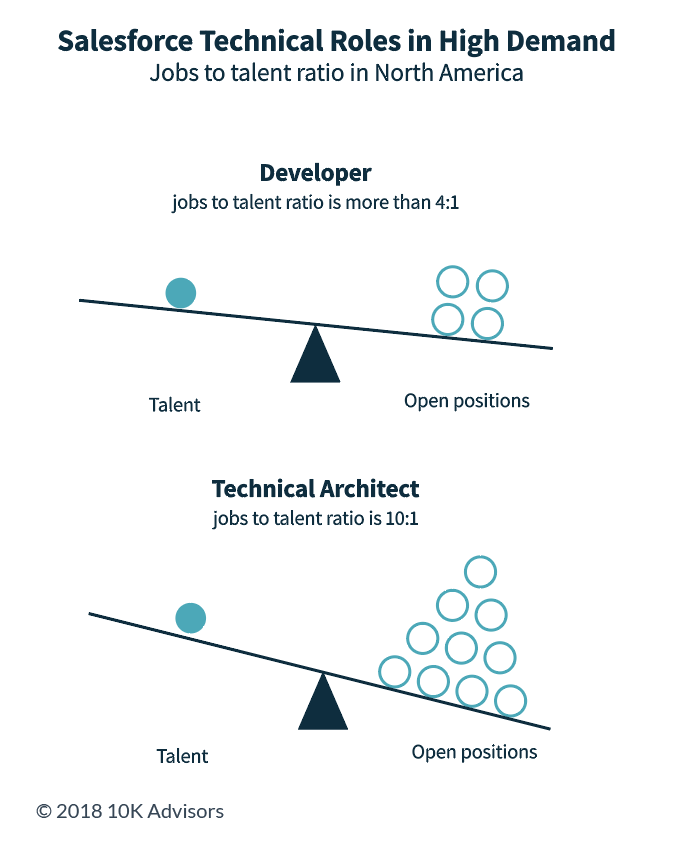

In North America, openings for Salesforce Developer jobs outpace available talent by more than 4:1 and Technical Architect jobs outpace available talent by an astounding 10:1. That imbalance between supply and demand is happening across almost every role and market.

In North America, openings for Salesforce Developer jobs outpace available talent by more than 4:1 and Technical Architect jobs outpace available talent by an astounding 10:1. That imbalance between supply and demand is happening across almost every role and market.

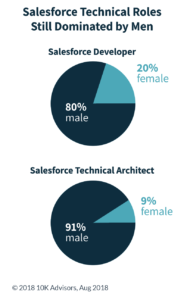

We also knew gender diversity is a problem in the tech sector, and even with Salesforce’s push around gender equality, we expected it to be a problem in this ecosystem as well. However, there was more parity than we expected in some roles and some markets, while the gender asymmetry was much higher than we expected in other roles.

An analysis of LinkedIn profiles indicates those currently holding a Salesforce Administrator position are on average 48% female and 52% male in North America. This is higher than average for these types of roles when you compare it to statistics from the U.S. Department of Labor. However, when it comes to higher paying technical roles like Developer and Technical Architect, that disparity is much more stark. In established markets, Technical Architects, the highest paying role, are 91% male and Developers, the second highest paying role, are 80% male.

Finally, we looked at the talent within the Salesforce partner ecosystem. While we weren’t surprised at the breadth and depth of the partner ecosystem, we were surprised at the consolidation of talent and the number of small firms and freelancers cropping up to serve this growing market. According to an AppExchange analysis, the top 10 consulting partners account for 55% of Salesforce professionals in the partner ecosystem, scattering the remaining 45% across smaller firms. More than 700 firms list less than 10 professionals, and 558 list less than 5 professionals.

Add to that the 5,000+ Salesforce-specific freelancers who are embracing the gig economy, and it’s clear that there is a growing opportunity for businesses at the long tail of the market. However, for customers who lack the time, resources or expertise to navigate across these smaller firms and untested freelancers, finding the right fit can be difficult.

What does this mean for the Salesforce ecosystem?

There are a few implications.

There are a few implications.

First, the imbalance between supply and demand, especially in the area of hard-to-find talent like Technical Architects and Developers, could spell problems for Salesforce customers and even Salesforce itself if left unchecked. Without the appropriate knowledge and guidance, large and more advanced Salesforce programs are more likely to accumulate technical debt, require future rework, and never realize their full potential. This could hurt customer satisfaction and the uptake of new features, which could ultimately cause customers to look elsewhere.

None of this is likely news to Salesforce. They understand the importance of having an adequate and diverse supply of skilled resources for their ever expanding set of applications, which is why Trailhead will continue to be a big area of investment for the company. Trailhead is already making big strides in training up more resources. In 2018, Salesforce reported its community had earned 8 million trailhead badges. Not bad for a program that was launched less than four years earlier.

The high demand for technical roles, and the lack of diversity, can be seen as both an opportunity and a challenge for those in the ecosystem. There are lucrative and fast-growing career opportunities for those who can acquire the skills, earning average salaries of $125,000 (for Developers) and $150,000+ (for Technical Architects). However, getting certified in these roles is not easy. Salesforce is already making it a point to address gender diversity, however they and partners throughout the ecosystem need to step up to grow the ranks of these critical roles across regions and across genders, or we (and Salesforce customers) will end up paying the price.

Finally, there are some implications to the partner ecosystem. Large companies and the big 10 consultancies will likely experience a new set of dynamics when competing for talent as more and more employees are choosing the flexibility of the “gig economy” over the stability of full time employment. This isn’t just junior employees. A recent Deloitte study showed that 7 in 10 millennials who are members of senior management teams or on boards would consider taking on short-term contracts or freelance work as an alternative to full-time employment.

The rise of small consultancies and freelancers may provide customers with a relatively untapped source of talent, however, distinguishing which individuals are right for a specific job or company culture is not easy. As buyers are forced to tap into Salesforce skills outside of the traditional consultancies or full-time employment, expect a new breed of full-service talent brokers to become a meaningful partner in helping organizations win the war for Salesforce talent.

For more talent trends and predictions, I’d encourage you to read the full report and would welcome any thoughts or feedback for our next report, which we expect out in Q1 2019.